Introduction

cycleTrendR provides a unified framework for analyzing time‑series that contain both trend and cyclic components. It supports:

LOESS, GAM, and GAMM trend estimation

Automatic Fourier harmonic selection (AICc/BIC)

Bootstrap confidence intervals (IID or MBB)

Change‑point detection

Lomb–Scargle periodogram for irregular sampling

Rolling‑origin forecasting

Publication‑quality ggplot2 visualizations

This vignette demonstrates the main workflows using simulated data.

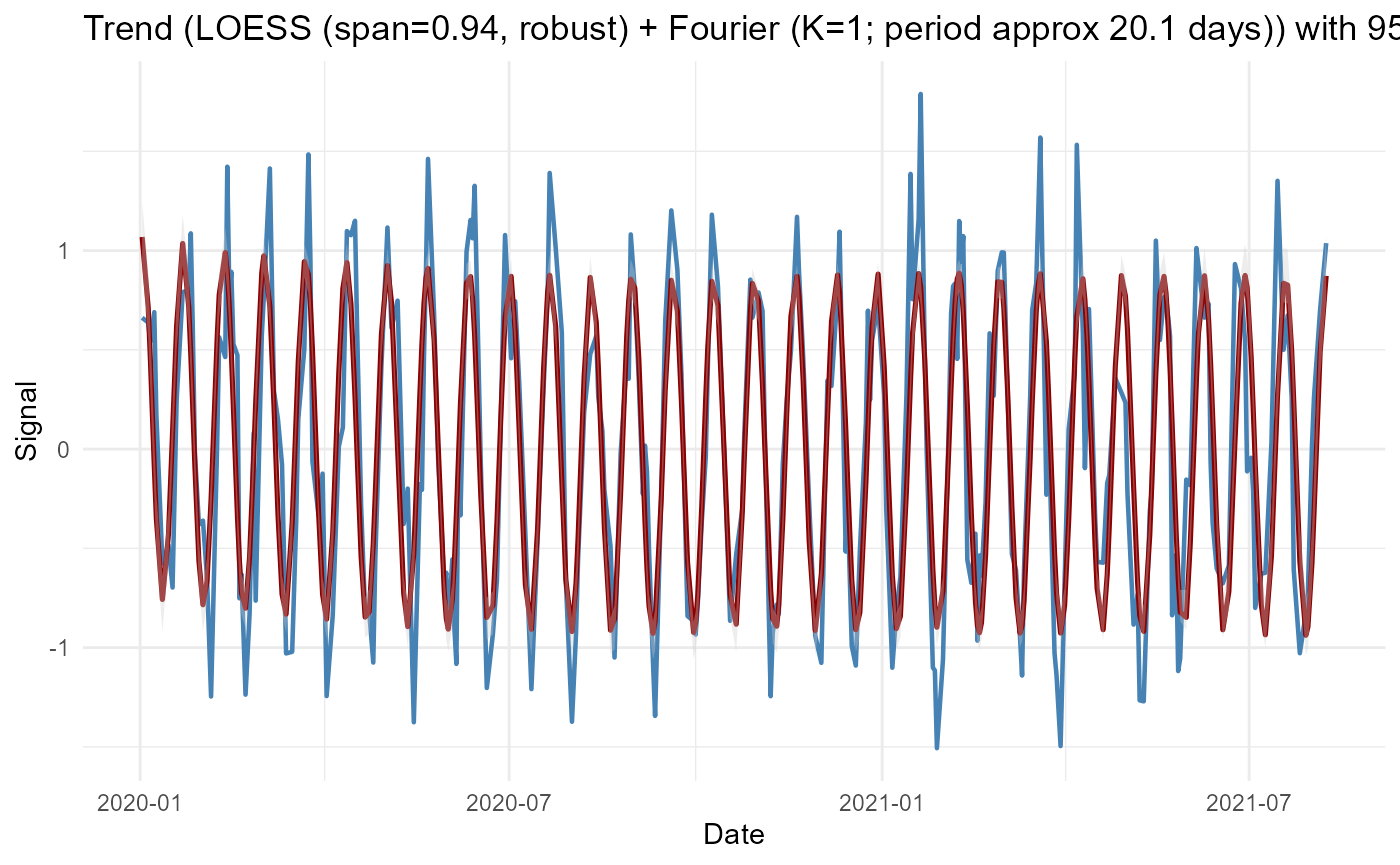

LOESS Trend + Automatic Fourier Selection

res_loess <- adaptive_cycle_trend_analysis(

signal = signal,

dates = dates,

trendmethod = "loess",

usefourier = TRUE,

auto_fourier_select = TRUE,

nboot = 50

)

#> Using original scale.

#> Irregular dates detected: Lomb Scargle + LOESS/GAM(M)

#> Auto seasonality: dominant period approx 20.14 samples -> seasonalfrequency=20

#> loess.as proposed span (criterion=aicc) = 0.944

#> Fourier selection: criterion=AICc -> K=1 (from 0..6)

#> Warning in adaptive_cycle_trend_analysis(signal = signal, dates = dates, :

#> Model-based CI not implemented for this configuration; switching to

#> bootstrapiid.

#> Bootstrap CI (bootstrapiid): 50 resamples

#> Warning in tseries::adf.test(signal, alternative = "stationary"): p-value

#> smaller than printed p-value

#> Warning in tseries::kpss.test(signal, null = "Level"): p-value greater than

#> printed p-value

res_loess$Plot$Trend

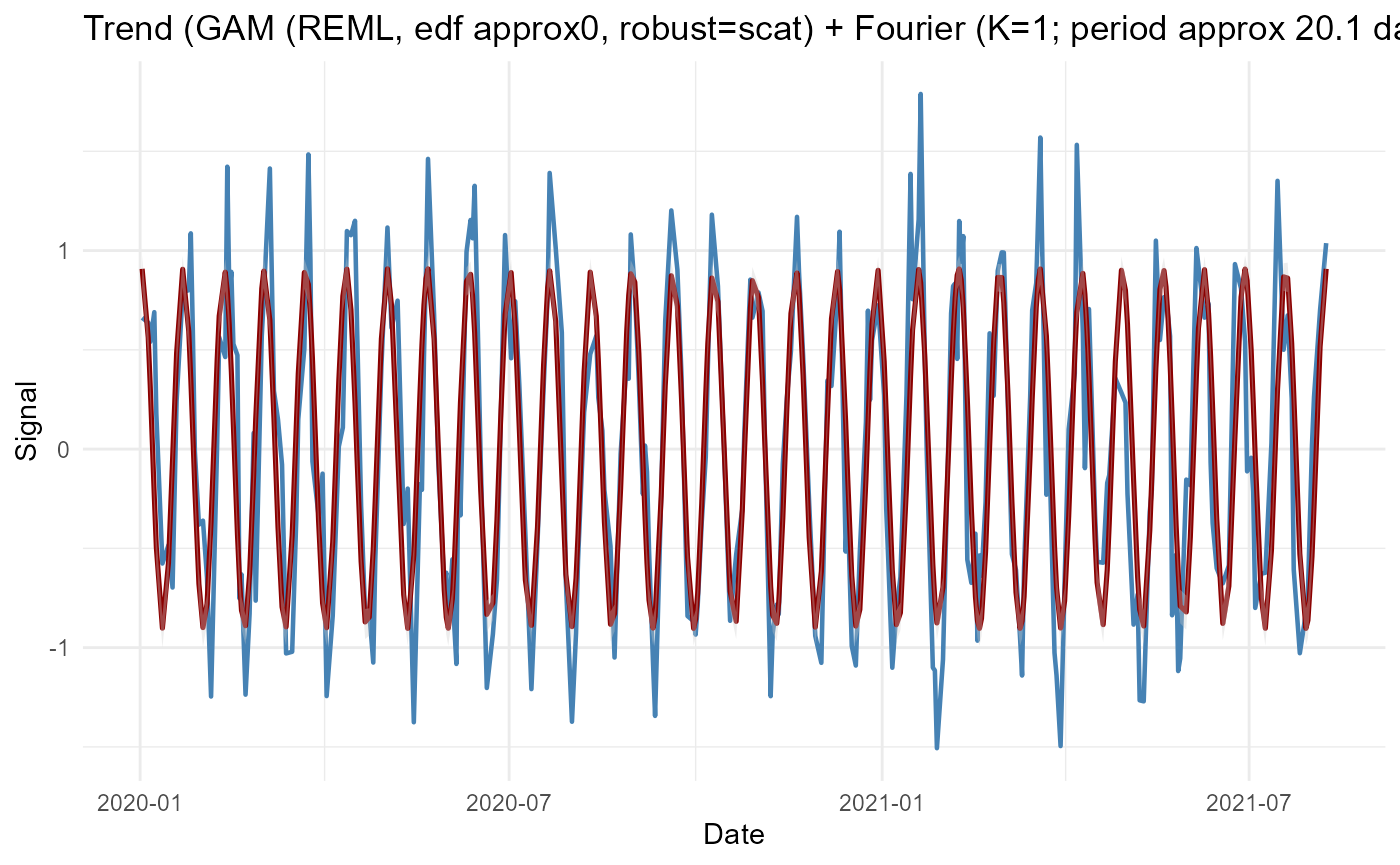

GAM Trend

res_gam <- adaptive_cycle_trend_analysis(

signal = signal,

dates = dates,

trendmethod = "gam",

usefourier = TRUE,

nboot = 50

)

#> Using original scale.

#> Irregular dates detected: Lomb Scargle + LOESS/GAM(M)

#> Auto seasonality: dominant period approx 20.14 samples -> seasonalfrequency=20

#> Fourier selection: criterion=AICc -> K=1 (from 0..6)

#> Warning in adaptive_cycle_trend_analysis(signal = signal, dates = dates, :

#> Model-based CI not implemented for this configuration; switching to

#> bootstrapiid.

#> Bootstrap CI (bootstrapiid): 50 resamples

#> Warning in tseries::adf.test(signal, alternative = "stationary"): p-value

#> smaller than printed p-value

#> Warning in tseries::kpss.test(signal, null = "Level"): p-value greater than

#> printed p-value

res_gam$Plot$Trend

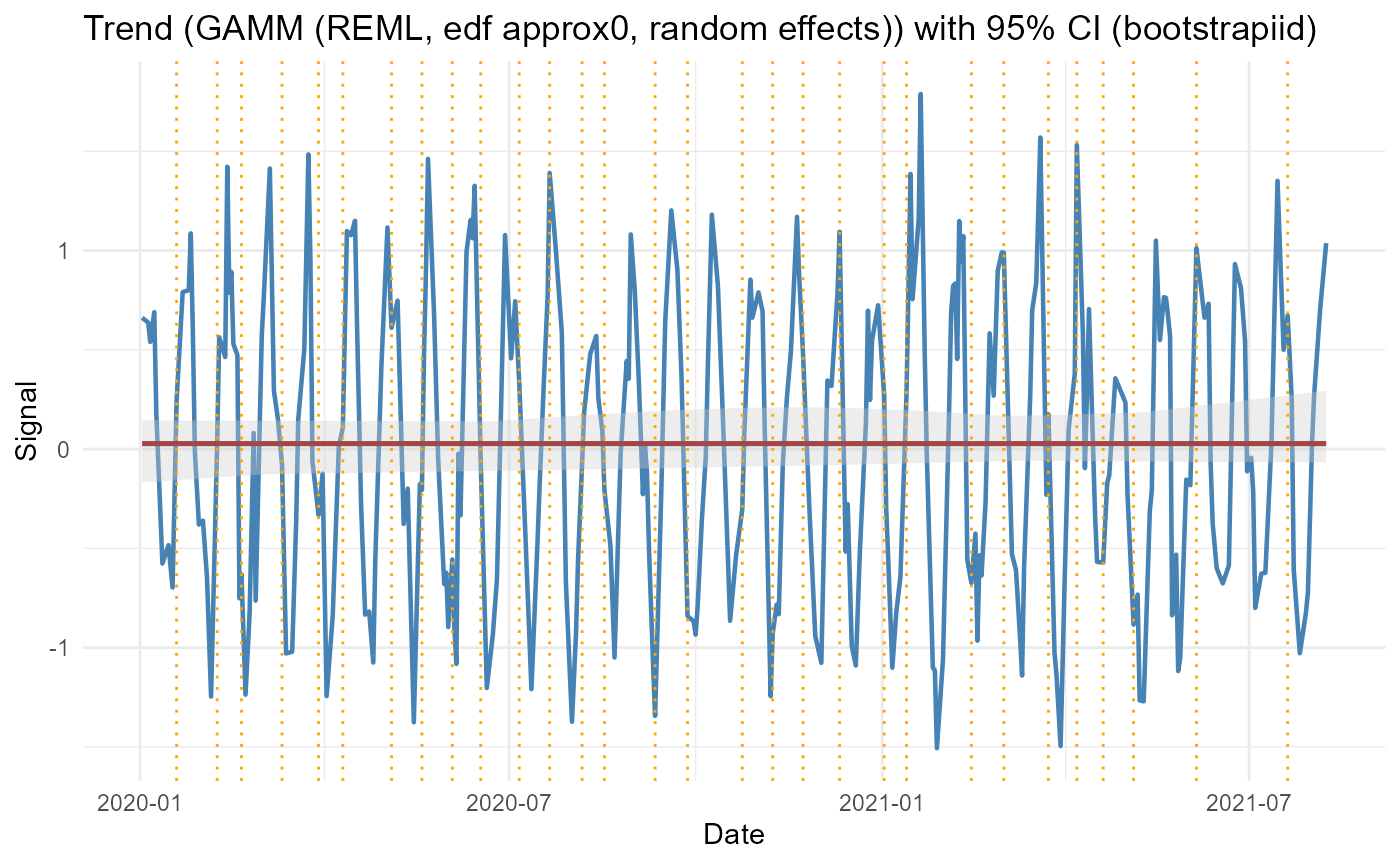

GAMM Trend with Random Effects

group <- rep(letters[1:4], length.out = length(signal))

res_gamm <- adaptive_cycle_trend_analysis(

signal = signal,

dates = dates,

trendmethod = "gam",

use_gamm = TRUE,

group_var = "subject",

group_values = group,

usefourier = FALSE,

nboot = 20

)

#> Using original scale.

#> Irregular dates detected: Lomb Scargle + LOESS/GAM(M)

#> Attached grouping column 'subject' from `group_values`.

#> Converted group_var 'subject' to factor (4 levels).

#> Auto seasonality: dominant period approx 20.14 samples -> seasonalfrequency=20

#> Warning in adaptive_cycle_trend_analysis(signal = signal, dates = dates, :

#> Model-based CI not implemented for this configuration; switching to

#> bootstrapiid.

#> Bootstrap CI (bootstrapiid): 20 resamples

#> Warning in tseries::adf.test(signal, alternative = "stationary"): p-value

#> smaller than printed p-value

#> Warning in tseries::kpss.test(signal, null = "Level"): p-value greater than

#> printed p-value

res_gamm$Plot$Trend

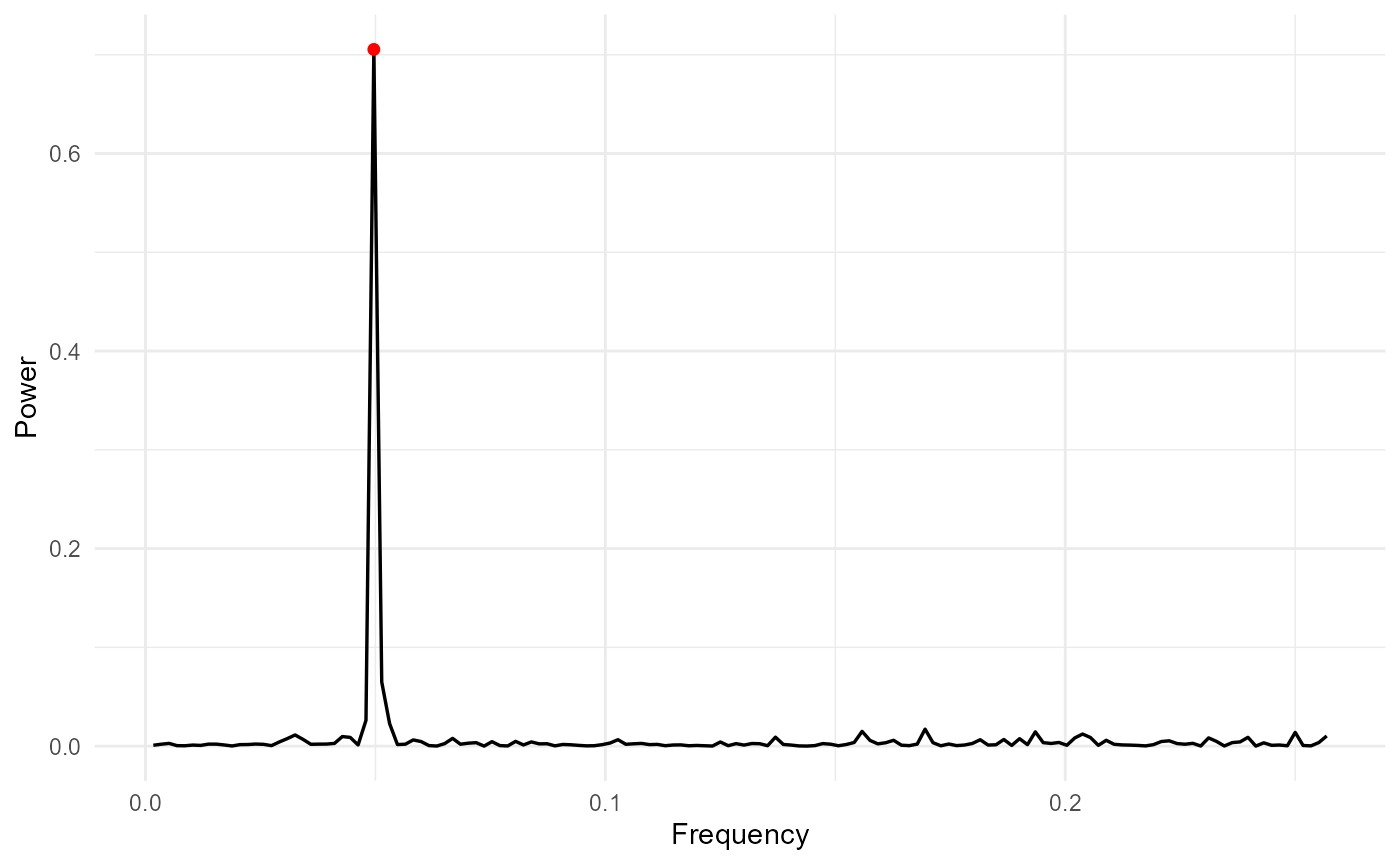

Irregular Sampling + Fourier + Lomb–Scargle

Irregular sampling is detected automatically and the Lomb–Scargle periodogram is used:

res_irreg <- adaptive_cycle_trend_analysis(

signal = signal,

dates = dates,

trendmethod = "loess",

usefourier = TRUE,

auto_fourier_select = TRUE,

nboot = 50

)

#> Using original scale.

#> Irregular dates detected: Lomb Scargle + LOESS/GAM(M)

#> Auto seasonality: dominant period approx 20.14 samples -> seasonalfrequency=20

#> loess.as proposed span (criterion=aicc) = 0.944

#> Fourier selection: criterion=AICc -> K=1 (from 0..6)

#> Warning in adaptive_cycle_trend_analysis(signal = signal, dates = dates, :

#> Model-based CI not implemented for this configuration; switching to

#> bootstrapiid.

#> Bootstrap CI (bootstrapiid): 50 resamples

#> Warning in tseries::adf.test(signal, alternative = "stationary"): p-value

#> smaller than printed p-value

#> Warning in tseries::kpss.test(signal, null = "Level"): p-value greater than

#> printed p-value

res_irreg$Plot$Spectrum